|

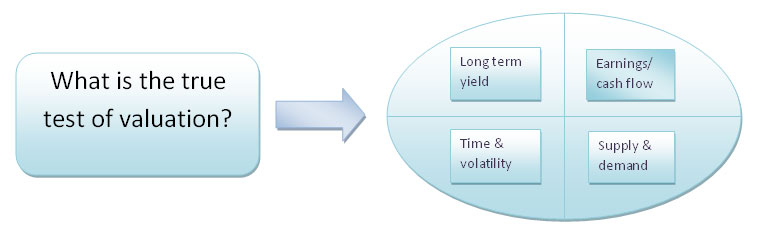

Our methodology blends the hedged world of option pricing with a long-term fundamental view of capital appreciation. We have our eyes on the market and our foot not far from the break; managing risk by consistently balancing the emotions of the market helps us to grow our portfolio one step at a time. We focus on optimizing returns and minimizing risk. Our strategy exploits the inherent disconnection between an option and its underlying equity. Our goal is to utilize the natural versatility of options coupled with the strategic mispricings of derivative markets.

We favor short options positions concentrated in high-beta names; targeting strong businesses, reasonable P/Es, good free-cash-flow, and little debt. We also seek low probability events that offer fixed risk. Margin is stressed tested against worst case scenarios with backstops in place. We manage the low risk coefficient inherent in hedging.

|

||

108-18 72nd Ave. (2nd Fl.) Forest Hills, NY 11375 .,....Main: 203-856-4119 .,....Email: DMC@davidmatthewscapital.com |

Copyright ©2011- David Matthews Capital Advisory L.P. All Rights Reserved. |