|

|

||||

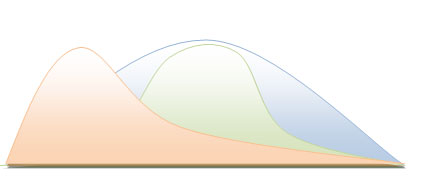

We control for and benefit from the many faces of market distributions (as shown below).

Our strategy is built on a solid understanding of the mathematics and fundamentals that move the market. We measure positions on a risk-adjusted basis and look meticulously for potential arbitrage. Recurring themes include:

Drawing on the structure of the market, we begin our investment process by searching for relative and true value. From there, we direct positional considerations to ever-changing option deltas and gammas. We measure the relationship of an options price to its underlying, both in terms of correlation (delta) and rate of change of said correlation (gamma). This allows for further opportunity in divesting risk and attracting seamless capital appreciation.

Overall, our derivatives strategies allow for multiple positional directives with limited exposure to adverse market conditions. While investments may involve possible substantial loss of initial capital, we have created a fund that addresses many of the issues on investors’ minds. That is, we pursue consistent long-term capital appreciation in a fashion non-correlated to market conditions. In essence, our mission is that of a true hedged fund.

|

||||

108-18 72nd Ave. (2nd Fl.) Forest Hills, NY 11375 .,....Main: 203-856-4119 .,....Email: DMC@davidmatthewscapital.com |

Copyright ©2011- David Matthews Capital Advisory L.P. All Rights Reserved. |